A widespread practice among industries characterized by around-the-clock operations is to incentivize employees to work less-than-desirable hours (or shifts) with premium pay above the base rate. A typical standard work week consists of eight hours somewhere between the hours of 6:00 am and 6:00 pm; anything beyond those hours requires the worker to adapt to an alternative schedule to accommodate family and lifestyle. Less desirable shifts include evenings, nights, and perhaps weekends. While not legally required, many companies voluntarily offer shift differentials, which are additional compensation for employees who work outside “normal” work hours, ensuring staffing for 24/7 operations. The premium most often applies to non-exempt, hourly workers; however, in unusual circumstances such as the pandemic, some organizations may elect to provide a “bonus” to exempt employees working additional shifts to cover a shortage of workers, as an example. Common industries with shift differentials include health care, hospitality, manufacturing, retail distribution or fulfillment centers, and security.

Employers determine the rates for shifts, often based on data and common industry practices reported in relevant salary surveys. The shift differentials are created and applied to specific jobs, positions, or groups of workers, not to the individual employee. In a union environment, these differentials are often included in bargaining and negotiations; but, if there is a choice between differentials and a percentage to base pay, most unions would prefer the additional percentage to base pay.

If permanently assigned to a shift, the base pay rate may reflect a higher rate. However, if shifts vary, companies pay the premium rates only for the duration of the shift. Once the shift assignment is over, the shift differential is no longer applied. If an employee temporarily picks up the graveyard shift, then he or she will want to be properly paid for the less desirable work hours. So, accurate accounting is critical.

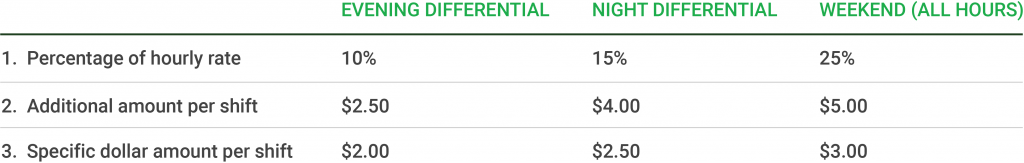

There are several ways to calculate premiums for shift differential pay:

- Percentage of base rate: The employee’s hourly rate is multiplied by a set percentage depending on the assigned shift. The additional amount is added to the rate and multiplied by the total number of hours worked on that particular shift.

- Additional dollar amount per hour: A premium rate is determined for all employees working a certain shift regardless of base rate. So, three employees earning $15, $20, and $22 per hour and working the night shift would each earn an additional $4 per hour, bringing their rates to $19, $24, and $26, respectively. The rates inclusive of the shift differential are multiplied by the number of hours worked during the shift to determine the earnings. Utilizing night shift differentials can help benchmark total pay and accurately price night shift roles, considering compensation differences between shifts.

- Specific dollar amount per shift: A set dollar amount is determined for working the shift, regardless of rate of pay. If the three employees mentioned above work the evening shift for the full five-day work week, then they each would receive an additional $2 per shift worked, or an additional $10. This amount is added to the earnings and divided by the total hours to determine the new rate of pay (for calculating overtime rates).

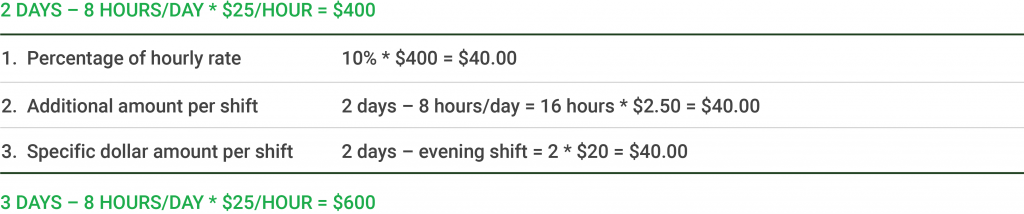

Example:

For example, an employee earns an hourly rate of $25.00. If assigned to work eight hours during the evening shift for two days of a weekly pay period, earnings are calculated as follows:

In each instance, total weekly earnings are $1,000. Of course, the rates have been simplified for the purposes of this demonstration. Shift differentials are not a legal requirement, so companies are allowed to determine the shift differential amounts and means of calculation. The compensation team would review historical payroll and employee data and project the need for the various shifts and labor, calculate the costs to the bottom line, and determine a rate that is both attractive to those working these shifts and cost efficient for the organization.

ERERI’s Salary Assessor includes a shift differential calculator for day, evening, or swing shifts. To learn more, visit ERI or contact ERI to schedule a guided tour.