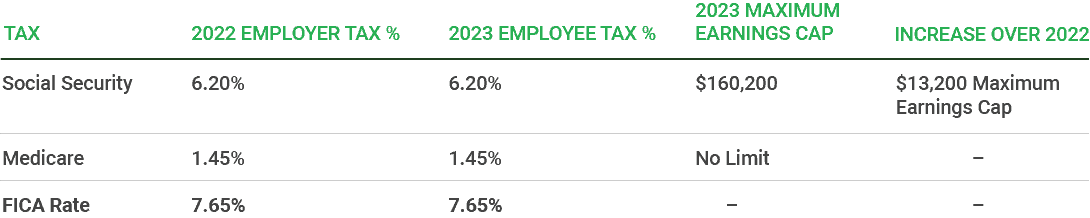

Effective January 1, 2023, the U.S. Social Security Administration will increase the maximum earnings subject to the Social Security payroll tax by $13,200 (from $147,000 in 2022 to $160,200 in 2023).

Note: Additional 0.9% Medicare tax withholding on FICA wages greater than $200,000 ($250,000 for married couples filing jointly) in a calendar year (paid by the employee).

Source: U.S. Social Security Administration

Social Security Fact Sheet

The Internal Revenue Service has announced 2023 IRA contribution limits, as well. Learn more by taking a look at our post breaking down all of the major changes.