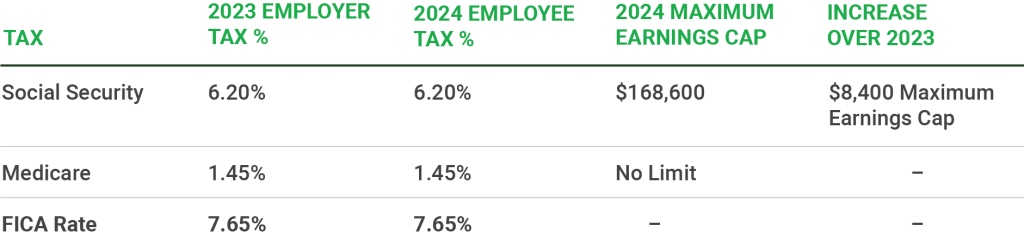

Effective January 1, 2024, the U.S. Social Security Administration will increase the maximum earnings subject to the Social Security payroll tax by $8,400 (from $160,200 in 2023 to $168,600 in 2024).

Source: U.S. Social Security Administration

Social Security Fact Sheet

The Internal Revenue Service has announced 2024 retirement plan contribution limits, as well. Learn more about them by looking at our post highlighting the major changes.

Salary Assessor

Retain employees and attract new talent. Know how much to pay.

About ERI

ERI Economic Research Institute compiles the best salary, cost-of-living, and executive compensation survey. Learn more about new compensation updates, rules and changes and how they affect business planning at ERI.