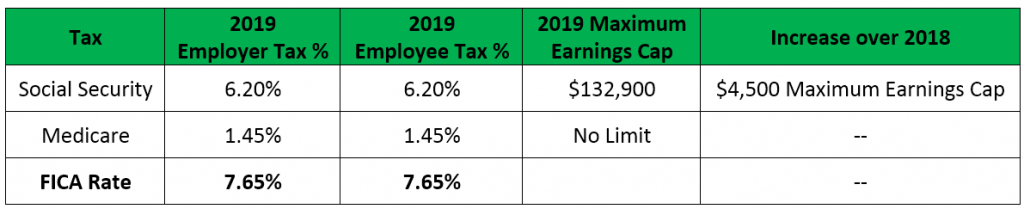

Effective January 1, 2019, the U.S. Social Security Administration will increase the maximum earnings subject to the Social Security payroll tax by $4,500 (from $128,400 in 2018 to $132,900 in 2019).

SSA Press Release: https://www.ssa.gov/news/press/releases/2018/#10-2018-1

SSA Fact Sheet: https://www.ssa.gov/news/press/factsheets/colafacts2019.pdf

Note: This excludes reference to the 0.9% employee-paid Medicare tax under a provision of the Affordable Care Act. See https://www.irs.gov/businesses/small-businesses-self-employed/questions-and-answers-for-the-additional-medicare-tax for more details.

ERI Economic Research Institute compiles the most robust salary, cost-of-living, and executive compensation survey data available, with current market data for more than 1,000 industry sectors. Find our most updated information, including our information on the 2020 Payroll Tax Increase.

ERI’s Assessor Series® – Solutions for every compensation decision