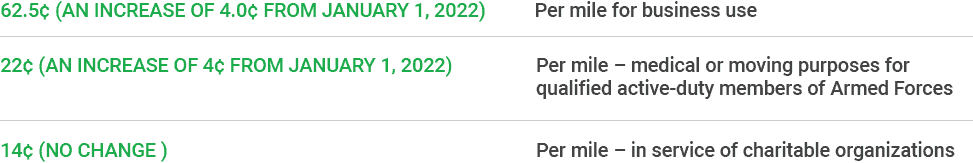

Effective July 1, 2022, the optional IRS standard mileage rates for operating an automobile (including vans, pickups, and panel trucks) for business, charitable, medical, or moving expenses have been updated as follows:

Also effective July 1, 2022, qualified active-duty members of the military are eligible for a new rate of 22 cents per mile for deductible medical or moving expenses. The standard mileage rates in service of charitable organizations remains unchanged.

These rates will remain in effect through December 31, 2022.

Please refer to the IRS Newsroom published on June 9, 2022, for additional details. Follow ERI’s blog for the latest compensation news and to stay updated on new and emerging compensation trends.