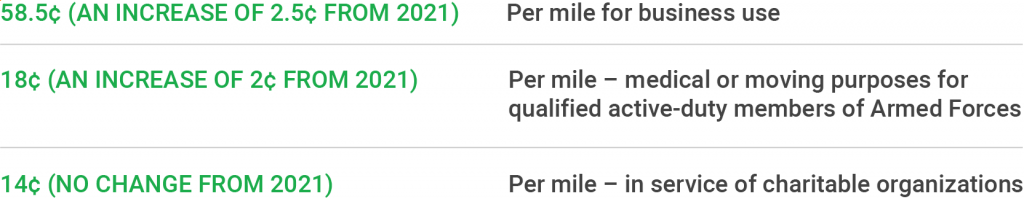

Effective January 1, 2022, the optional IRS standard mileage rates for operating an automobile (including vans, pickups, and panel trucks) for business, charitable, medical, or moving expenses are as follows:

The standard mileage rates in service of charitable organizations remained unchanged from 2021, with increases of 2 cents per mile for medical or moving purposes for qualified active-duty members of the Armed Forces and 2.5 cents per mile for business use. Compare and learn more about how the new 2022 optional IRS standard mileage rates differ from the 2021 optional IRS standard mileage rates.

Please refer to the IRS News Release published on December 17, 2021, for additional details.