Total compensation packages consist of all forms of compensation that an employee receives in exchange for work. Total compensation encompasses not only base pay/salary, but also the employer-paid costs of benefits, such as medical, dental, vision, 401(k) matching contributions, life insurance policies, holidays, paid time off, and more. Rewards statements can be a useful marketing tool, providing a frame of reference when comparing against external offers. On the surface, external offers may seem quite attractive; but perhaps they are not as enticing once all rewards are considered. Many employees don’t think about or fully understand the value of all the benefits offered – they are often taken for granted. Certain benefits may be more valuable depending on the employee. Retirement benefits may not take top priority for a new college graduate who is just starting a career but may be very significant to a person closer to retirement age. Health and welfare benefits may be very important to an employee with a young family or someone with a chronic health condition. Whatever the case may be, articulating the value of the benefits provided as part of the total compensation package is a key component of the overall compensation strategy.

Calculating the total compensation package consists of creating a list of all the benefits applicable to the job, which may vary depending on the job. For example, senior-level leaders may receive additional at-risk compensation and perquisites (e.g., auto allowance, gym membership) in addition to the standard list that all employees receive. The annual cost of the benefit (premiums) that is borne by the company is applied to each.

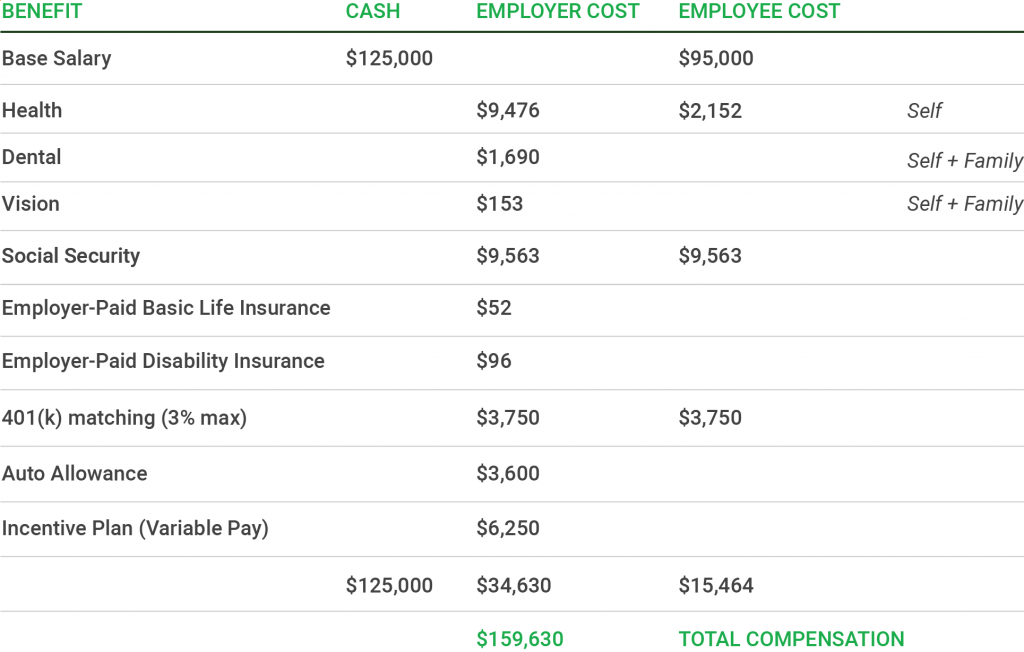

In the total compensation package example below, the employee earns an annual base salary of $125,000:

- Included in that salary are two weeks of paid time off, eleven paid holidays, and one week of sick time.

- Health coverage premiums are $11,628 annualized – employees share in the cost at a rate of 18.5% or $2,152; the employer portion is 81.5% or $9,476.

- Dental and vision coverage is provided at no cost to the employee.

- Basic life insurance and disability insurance are also provided at no cost to the employee.

- Both employer and employee contribute to Social Security at a rate of 7.65%.

- The employer contributes up to 3% matching to the employee’s 3% 401(k) contribution.

- At this level, the employee receives a monthly auto allowance of $300 or $3,600 annualized.

- Additionally, the employee participates in an annual incentive plan that pays up to a maximum 10% of base salary, depending on the goals achieved; the target payout for the plan is 5%.

The value of the total compensation package is $159,630 – that’s an almost 28% increase to the base salary!

Some generous benefits that many employers provide, beyond base salary, include the following:

- Health

- Dental

- Vision

- Basic life insurance

- Supplemental life insurance**

- Paid time off*

- Sick time*

- Tuition reimbursement

- Professional association memberships

- Short-term disability

- Long-term disability**

- Accidental death & dismemberment**

- Long-term care**

- Pet insurance**

- Retirement pension contributions (defined benefit contributions)

- 401(k) matching

- 11 paid holidays*

- Incentive bonus (variable pay)

- Stock, other long-term incentives

- Gym membership initiation fees

- Professional development – classes, certifications, etc.

- Flexible spending account – health & dependent care (pre-tax contributions)

*Included in base salary

**Typically paid by the employee, but pricing may be lower based on preferred employer group pricing

It’s wise and strategic for a company to be prepared to articulate the total compensation package. Equipping the talent acquisition team allows promotion of the organization beyond base pay, which can be especially important if base pay alone is not as competitive in comparison to another offer. However, when taking the broad view of what an organization can offer in addition to base pay, the candidate or employee has a wealth of information to help make an informed decision. For more information about how companies utilize compensation data to help plan business strategies, visit ERI.