Simply defined, a bonus is additional pay given on top of an employee’s regular pay or base salary. Companies use bonuses as a means to reward employees who work hard to help reach their strategic goals, as a thank you for a job well done, as recognition of teams for achievement of goals or projects, as a way of motivating employees and boosting morale, to attract candidates, or to maintain competitiveness within the industry.

The terms bonus and incentive are often used interchangeably; however, the major difference between the two is that most bonuses are discretionary, an addition to salary, and usually paid after the completion of a certain event. Leaders and managers decide who and how much. Incentives, on the other hand, are non-discretionary and based on the achievement of specific objectives set at the outset of the plan year and communicated to eligible employee participants. Bonuses look back; incentives look forward. It is important to make the distinction between the two and use the terms consistently. A written plan document outlining the plans is helpful in eliminating confusion and avoiding a culture of entitlement.

Different Types of Employee Bonuses

Generally speaking, bonuses are performance-based. A company distributes them based on how employees contribute to team or company goals. Bonuses may be distributed at a focal point – quarterly, annually, or on the spot – depending on the type of bonus and the participant eligibility. However, there are several other types of bonuses:

- Spot Bonus – As the name suggests, a spot bonus is awarded on the spot, when the performance is noted. It is usually tied to a special project, service beyond the call of duty, or an unexpected contribution to the company’s success. It is an occasional occurrence and could be a small cash award (in the form of a gift certificate), tickets to an amusement park or sporting event, or recognition in the company newsletter.

- Referral Bonus – Current employees are often great sources of recruitment, especially for hard-to-fill positions. A referral bonus encourages current employees to refer great candidates for jobs. It is typically not given until the candidate is hired and has completed the probationary period. This bonus is most commonly paid as a flat rate.

- Signing Bonus – This type of bonus provides an incentive for candidates to accept a new role. It is used when an employee is walking away from something (such as in the middle of a plan year that disqualifies the employee for a company bonus or incentive plan), as a form of a relocation package, or to make up for salary demands that cannot be met.

- Retention Bonus – A retention bonus is offered to entice valuable talent to stay with the company. It can be offered in response to a competing offer and is typically an increase to base salary. During a merger or acquisition, retention bonuses may be provided to encourage employees to see the company through a period of transition and paid on the backend, after the agreed upon period of time.

- Commissions – These are considered non-guaranteed compensation and depend upon the employee’s individual performance. Typically, sales jobs (as well as recruiting and many other jobs) are paid based on a commission structure using a set percentage or formula. Payment is distributed periodically, as defined by the plan, and when the commission is considered earned. The commission calculation is generally tied to a quota or goal.

- Annual Bonus – An annual bonus is usually performance-based, involving earnings, revenue, or some other measure that aligns with the strategic goals of the business. The bonus is tied to the organization’s strategic goals and is an incentive to drive performance. The company’s level of success determines the size of the bonus. This can also be considered “profit sharing.” Companies wait a full year before payout, and most plans require employees to be actively employed at the time of payout to receive the bonus.

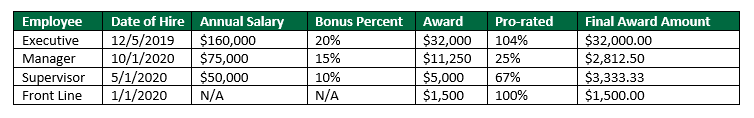

Depending on the complexity, most performance-based annual bonuses can be calculated with an Excel workbook. A sample plan on how to calculate bonus pay is described below.

QRS Company had a banner year, achieving all of its strategic goals. The board of directors has determined that a bonus is appropriate for the company employees:

- Front-line employees will receive a flat dollar amount of $1,500.

- Senior leaders will receive 20% of their annual salary, while managers and supervisors will receive 15% and 10%, respectively.

- Participation is prorated based on date of hire. The plan year is based on the annual calendar of January to December 2020.

- The bonus payout date is January 30, 2021, following the end of the plan year.

For the senior leader (executive) earning an annual salary of $160,000 and hired on 12/15/2019, the calculation is as follows:

ANNUAL SALARY * BONUS PERCENT

or $160,000 * 0.20 = $32,000

There is no need to pro-rate the amount since the executive was hired before the plan year.

The manager and supervisor bonuses are calculated using the same formula and prorated since both were hired within the plan year. The manager receives 25% (with 3 months of service), and the supervisor receives 67% (with 8 months in the role).

While the front-line employee receives the full flat dollar amount (based on length of service), the bonus may be subject to inclusion in computing the regular rate of pay if the employee is non-exempt. The DOL Code of Federal Regulations, section 29CFR778, provides details for consideration.

If the company did not perform well, a smaller bonus percentage may be used. For example, if the company reached 50% of its goals, then the bonuses would be prorated by 50%.

In summary, spot bonuses are often small cash awards or gift certificates, recognition, or amusement park or sporting event tickets. Referral and signing bonuses are usually flat dollar amounts. Retention bonuses can be a flat dollar amount or an increase to base salary. Commission calculations are tied to the company’s commission structure based on a percentage or formula and can be complicated. The annual bonus structure and calculation example provided above is straightforward, easy to calculate, and simple to understand; however, the structure can be as complex as the company decides to make it. Paying employee bonuses is a good way to energize and motivate employees but can have unintended negative consequences. Companies need to develop, and periodically review, a plan document that outlines the details of the bonus – that it is discretionary, what it is based upon, and if and when it will be calculated and paid out.