Salary increase budgeting appeared to be fairly typical at the start of 2022, with a 3.0-3.5% salary increase budget competitive at that time. Now mid-year, the labor environment and inflation clearly have challenged the appropriateness of the original 2022 budgets.

Although changes to salary increase budgets traditionally have trailed changes in the rate of inflation, this era of 3.0-3.5% salary increase budgets, the pandemic, the war in Ukraine, supply chain issues, low unemployment, tough labor competition, increased unionization, a looming recession, and the Great Resignation all require a competitive compensation plan and may even warrant a mid-year salary increase. The situation in this challenging labor market certainly tests an organization’s prior compensation decisions.

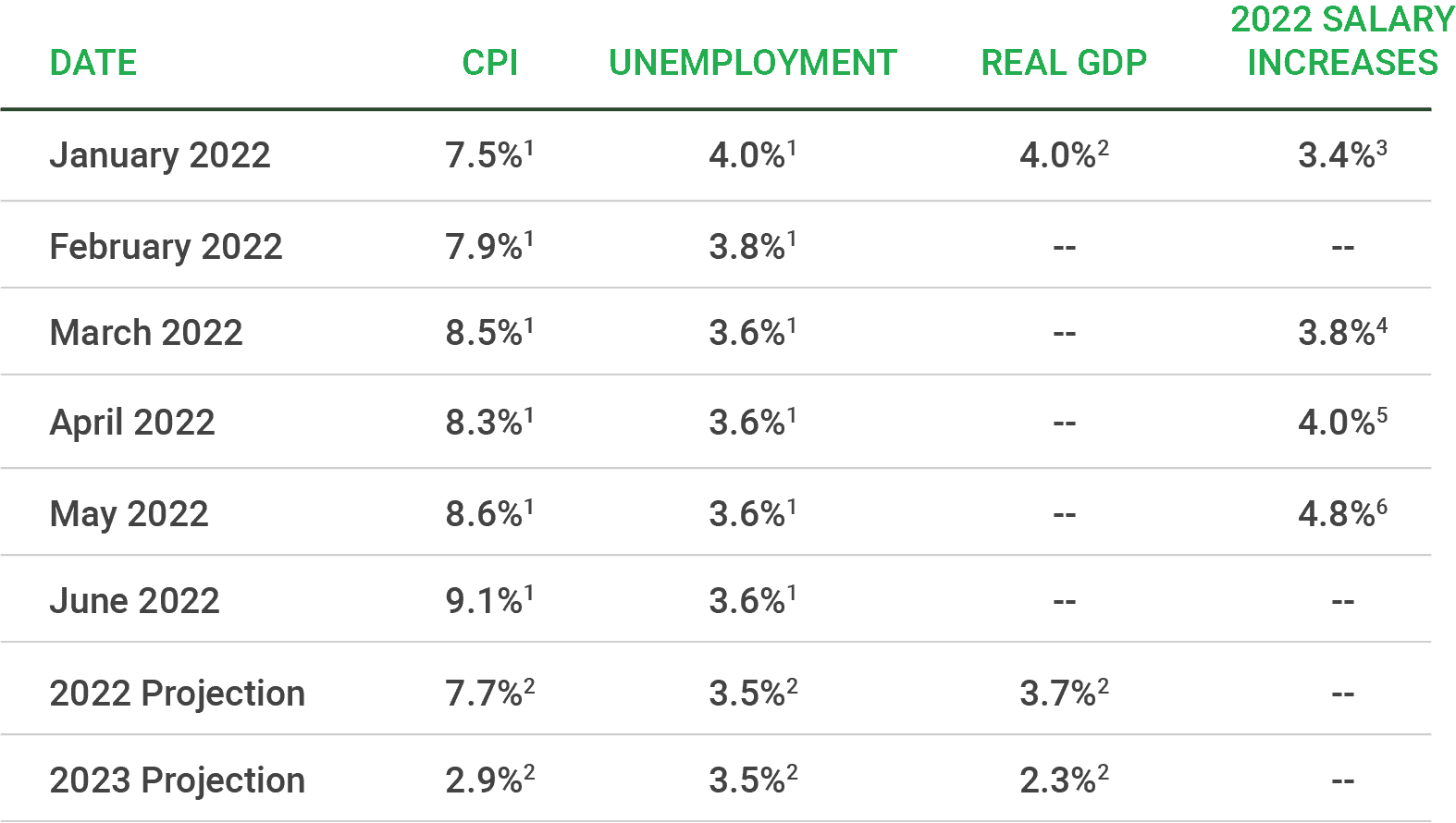

United States Trends and Indicators

There is a clear upward trend from the salary increase budgets reported at the beginning of 2022. Based on recent surveys, the increase over the original 2022 budget ranges from 0.4% up to 1.4%. Also, Microsoft announced that it has nearly doubled its global budget for merit-based salary increases and will increase its range for annual stock-based compensation by at least 25% for employees at the senior director level and below. Amazon has also increased the maximum base pay from $160,000 to $350,000 for corporate and tech employees to support in recruiting and retaining top talent. It is now common to see pay increases of 4.0% or more in 2022.

ERI’s April 2022 National Compensation Forecast explains the impact of inflation:

Inflation can influence the growth of total compensation, and the extent of that influence also varies depending on the level of inflation, with high inflation being related to higher levels of compensation growth. The real concern with compensation growth and inflation is the wage price spiral. This is a feedback loop where high inflation pushes up wages, which in turn push up inflation. Currently, inflation is exerting an upward force on compensation, but we have not seen evidence of compensation growth subsequently pushing up inflation. However, if inflation continues to increase, this phenomenon may become a reality. The exact inflation rate and duration of higher inflation that might lead to this spiral is unknown. However, double-digit inflation rates would cause concern. Especially if those higher rates were sustained over an extended period.

When inflation significantly increases, consideration of cost-of-living increases typically becomes more prevalent. For example, in the early 1980s, the United States had double-digit inflation with salary increase budgets of over 10%. During that time, some companies elected to deliver both merit increases and cost-of-living increases, though they were frequently administered on two different dates. Keep in mind, salary increases frequently trail changes in inflation—they do not always change at the same time or percentage.

Fixed vs. Variable Compensation

Traditionally, employees’ base salaries represent the highest component of fixed pay and are used to pay for fixed expenses, such as rent or mortgage payments, utilities, food, clothing, and required services.

In the past several years, bonuses or short-term incentive compensation have been increasingly used and commonly paid out based on an organization’s results and/or individual/team performance. Traditional variable compensation is not a viable solution to address the impact of high inflation on employees since it is “at risk” compensation.

As fixed monthly expenses for employees increase due to inflation, employees will look to their fixed compensation to pay for these expenses. If employees’ purchasing power erodes too much, they will seek alternative income sources or cost-saving opportunities.

The Great Resignation

The top three reasons typically given for the Great Resignation, or the ongoing trend of widespread voluntary resignations in recent years, are employees looking for one or more of the following:

• Increased compensation

• Better employee benefits

• Improved work-life balance

When workers can typically expect 3-4% pay increases from their current employers, but changing employers often produces an 8-10% increase in pay, moving to another organization certainly helps employees keep up with inflation.

About 60 million people worked as contractors in 2021, but 25% of those workers (15 million people) would not choose to remain as independent contractors. These workers are likely included in the Great Resignation and are seeking higher compensation and improved employee benefits as regular employees.

The pandemic certainly gave employees a reason to look at their work-life balance. Remote work opportunities give employees the chance to improve their personal and family’s work-life balance and even relocate to more affordable and desirable locations.

Compensation in a Challenging Labor Market and Inflationary Environment

It is difficult to assess how long this challenging labor market and inflationary cycle will last. If it is a one-year cycle, it is best to manage 2022 increases separately. However, if it becomes an ongoing inflationary cycle that lasts several years, inflation needs to be considered when managing pay increases.

Consider the following to support employee retention in this challenging environment:

- Nonexempt and lower-level exempt employees tend to feel the greatest monetary impact from inflation. Their fixed expenses are significant as compared to their incomes. Ensure they are paid competitively to the labor market. Consider a lump-sum payment or a one-time retention bonus to offset inflation in 2022. This assumes that inflation will taper down once the cost of oil decreases. It supports a business by not adding to ongoing fixed compensation expenses.

- Consider looking at the market competitiveness of critical employees, at-risk jobs and job families, and high performers within the organization in lieu of across-the-board increases.

- What is the overall market competitiveness at base pay within your organization? What is the overall market competitiveness at total cash compensation at target within your organization? Is your compensation mix appropriate in this unique environment?

- Can the goals and objectives of your 2022 incentive plan document be updated to better meet the latest goals and objectives of 2022?

- Should any jobs be changed to classify the role more accurately (e.g., exempt or nonexempt, temporary or regular, benefit-eligible job classification, etc.)?

- Is your overall total rewards plan market competitive? Which adjustments are necessary to ensure the ability to attract and retain a talented workforce in this unique environment?

- The majority of companies are now implementing higher pay increases than last year. With your top management support, consider the overall 2022 adjusted salary increase budget at 4.0% or above, depending on your industry and competitive requirements.

- Early projections for 2023 indicate that U.S. salary increase budgets for 2023 could average 4.1%.

ERI’s July 2022 National Compensation Forecast provides important additional insight into the current economic environment to support in your compensation decisions.

Sources:

1 Bureau of Labor Statistics

2 12-Month Projection – International Monetary Fund – World Economic Outlook

3 ERI Economic Research Institute (projected increase budget)

4 Mercer Pulse Survey (total increases including 0%)

5 Willis Towers Watson (actual average increase)

6 Pearl Meyer Poll (implemented total base salary increases)