If you have ever worked in a minimum wage position in different states or even in various cities, you would have noticed differences in the compensation amounts. In this article, we will explore the various aspects of state minimum wages in the United States and how your location and occupation affect your starting wage.

State Minimum Wage Laws

While there is a federal minimum wage mandated by the Fair Labor Standards Act (FLSA), currently $7.25 per hour, individual states have the authority to set their minimum wage rates to suit their needs. Some states have not increased their state minimum wage for over a decade, whereas others have raised their rates regularly to better reflect the local cost of living.

As of 2024, 20 states have not increased their wages for ten or more years:

- Alabama

- Georgia

- Idaho

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Mississippi

- New Hampshire

- North Carolina

- North Dakota

- Oklahoma

- Pennsylvania

- South Carolina

- Tennessee

- Texas

- Utah

- Wisconsin

- Wyoming

On the other hand, 22 states increased their minimum wage rates at the start of the 2024 calendar year.1 Here are the new rates compared to the previous year:

| State | 2024 Minimum Wage | 2023 Minimum Wage |

|

Alaska |

$11.73 |

$10.85 |

|

Arizona |

$14.35 |

$13.85 |

|

California |

$16.00 |

$15.50 |

|

Colorado |

$14.42 |

$13.65 |

|

Connecticut |

$15.69 |

$15.00 |

|

Delaware |

$13.25 |

$11.75 |

|

Hawaii |

$14.00 |

$12.00 |

|

Illinois |

$14.00 |

$13.00 |

|

Maine |

$14.15 |

$13.80 |

|

Maryland |

$15.00 |

$13.25 |

|

Michigan |

$10.33 |

$10.10 |

|

Minnesota |

$10.85 |

$10.59 |

|

Missouri |

$12.30 |

$12.00 |

|

Montana |

$10.30 |

$9.95 |

|

Nebraska |

$12.00 |

$10.50 |

|

New Jersey |

$15.13 |

$14.13 |

|

New York (NYC, Long Island, and Westchester) |

$16.00 |

$15.00 |

|

New York (remainder of state) |

$15.00 |

$14.20 |

|

Ohio |

$10.45 |

$10.10 |

|

Rhode Island |

$14.00 |

$13.00 |

|

South Dakota |

$11.20 |

$10.8 |

|

Vermont |

$13.67 |

$13.18 |

|

Washington |

$16.28 |

$15.74 |

Regional and Industry Differences

Even within states and counties, there can be variations in minimum wage rates due to specific regional disparities, such as cost of living, industry or occupation of the employee, or even city borders.

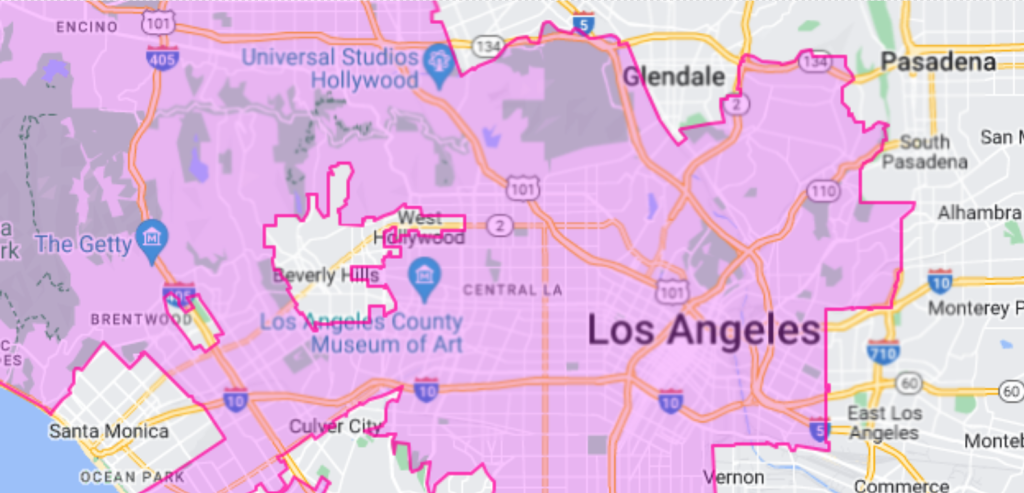

Consider the city of Los Angeles, for example, where pocket areas are subject to their own laws since they are not considered part of the city. For a visual example of the outliers, you can see the unhighlighted areas that are not considered part of L.A.

A prominent example is West Hollywood, given its unique position of being surrounded by Los Angeles territory. In West Hollywood, all employees have starting rates of $19.08 for all occupations (as of July 1, 2023).

For comparison, we can see that the lowest possible starting minimum wage is $16.78 for the city of Los Angeles (as of July 1, 2023).

In addition to the base minimum wages displayed on the charts, there are different starting wages for certain industries, as well as specific exceptions, based on the laws of their respective jurisdiction.

Indexing to Inflation

Some states have implemented policies where their minimum wage is indexed to inflation, ensuring that it keeps pace with the cost of living as it rises over time. To be more specific, these states adjust and raise minimum wage accordingly based on the year-over-year increases in the Consumer Price Index (CPI). This methodology has been adopted by 19 states and Washington, D.C:

- Alaska

- Arizona

- Colorado

- Connecticut

- Florida

- Maine

- Minnesota

- Missouri

- Montana

- Nebraska

- Nevada

- New Jersey

- New York

- Ohio

- Oregon

- South Dakota

- Vermont

- Virginia

- Washington

- Washington, D.C.

Tipping Laws

In some states, employers are allowed to pay a lower base wage to tipped employees (such as servers or waiters) so long as their total earnings (including tips) meet or exceed the regular minimum wage. These variations can influence the effective minimum wage rates for tipped employees in different states.

For example, one of the best states for tipped employees is California, which allows them to combine their hourly base wage of $16 with their tips without the total amounts being capped. On the other hand, there are a handful of states that have their tipped wage start at a reduced minimum wage, such as the federal minimum of $2.13 per hour for tipped employees, and their remaining wages will be either covered by tips or the employer. Some of the states with unfavorable tipped worker minimum wage laws are Alabama, Georgia, Kansas, Mississippi, North Carolina, Texas, and Utah.2

Final Thoughts

In conclusion, the minimum wage landscape in the United States is a complex web of state regulations, regional disparities, and industry-specific variations. While the federal minimum wage provides a baseline, individual states have the authority to set their own rates, leading to significant differences in compensation amounts across the country. Myriad factors, such as the cost of living, regional disparities, indexing to inflation, and tipping laws, further contribute to the variations in minimum wage rates. Understanding these factors is essential for individuals navigating the job market, as their location and occupation can significantly impact their starting wage and overall financial well-being.

It is important to note that minimum wage laws are subject to change as state legislatures continue to debate and enact new policies. For the most up-to-date information on minimum wage rates in specific states, it is recommended to consult with official state labor department websites, reliable sources for labor law information, or ERI’s Geographic Assessor.

1 Twenty-two states will increase their minimum wages on January 1, raising pay for nearly 10 million workers. Economic Policy Institute. (n.d.). https://www.epi.org/blog/twenty-two-states-will-increase-their-minimum-wages-on-january-1-raising-pay-for-nearly-10-million-workers/

2 Minimum wages for tipped employees. DOL. (n.d.). https://www.dol.gov/agencies/whd/state/minimum-wage/tipped