Chapter 12: Salary Structure Design

Overview: A step-by-step guide on how to create a salary structure, including setting market rates, pay ranges, pay policy lines, pay grades and rate ranges.

Corresponding Courses

82 Creating a Market Competitive Salary Structure

83 Designing a Geographic Salary Structure

So far, this book has examined pay from two perspectives: the external market forces and the internal value of jobs to the organization. To pay employees correctly and fairly both of these perspectives must be taken into account. This is the task of establishing a salary structure. The tools for doing this are:

- The job structure as developed in the previous chapter of job evaluation

- The pricing placed on jobs by conducting a salary survey, and

- The pay level decisions based on how the organization ranks the salary survey priced jobs.

Salary structures provide pay rates for specific jobs and determine the relationships between these rates by combining the pay level, specific market pay rates and the job structure.

DEVELOPING A SALARY STRUCTURE

Salary structures result from pricing job structures. Job structures, in turn, result from the application of formal or informal job evaluation to an organization's jobs (see Chapter 11). In order to price a job structure, it is necessary to use dollar amounts from either current pay rates or the market data collected from salary surveys (see Chapter 8). A salary structure, then, is a combination of the job structure, the labor market, and the organization's decisions regarding the pay level. The pricing of job structures is subject to the influences discussed in Chapter 9 on salary structure determinants plus some technical ones. For example, the manner in which job relationships were determined may influence job pricing. If a formal job evaluation plan was employed, the type of plan has an effect. The extent of union involvement in a formal job evaluation program may also influence job pricing. If an informal job evaluation was used to determine the job structure, the pricing process may be influenced by whether the informally derived job structure makes use of pay grades or separate jobs. Both unions and management tend to favor simplification of pay structures, however, and this agreement reduces the variation in pricing procedures.

The present salary rates in an organization will clearly influence any changes made in its current salary structure. The current rates represent a series of decisions about all aspects of the program, including past market rates, organizational differentials, and customary differences that have survived.

Most often, however, the job structure is priced out through the use of market rates. This means the employment of salary surveys. (See Chapter 8 and ERIDLC Course 73: Analyzing Salary Surveys.) Salary survey results are often employed as an important and at times the only consideration in pricing job structures as will be examined toward the end of this chapter. This exclusive use is most often limited by the fact that surveys usually secure data on a limited number of key jobs that vary in importance and cost significance from one organization to another. A second limitation is that evaluated rates may easily be above market rates for certain jobs. Hence, market rates while a very important factor in pricing jobs are not the only consideration. As will be seen, however, if market rates are higher than evaluated rates, market rates are usually followed.

The cost consequences of jobs often influence job pricing just as much as market rates do. In most organizations, there is a fairly well-defined group of jobs that represents an important segment of the total labor costs of the company. It is important to note that although some organizations are more restricted by labor cost considerations than others, prices assigned this group of jobs may greatly affect an organization's competitive position. Rates assigned these jobs during job-structure pricing largely determine the pay level of the firm, and salary structure relationships are built around this cost center.

Pricing a Job Structure

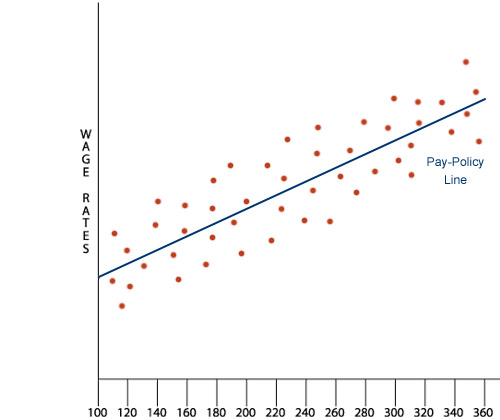

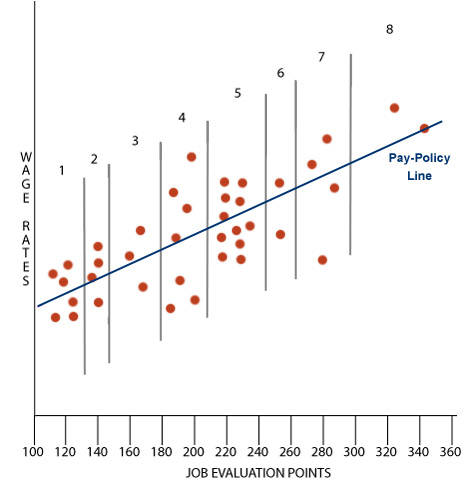

The job structure presents the compensation decision maker with a hierarchy of the jobs in the organization. Ordinarily, this hierarchy has been developed by the use of job evaluation and represents the organization's relative rating of its jobs. A dollar value now needs to be placed on this hierarchy. This dollar value is available in the current pay rates paid for the jobs and/or in the salary survey data representing the labor market. These two sets of data can be illustrated by the use of a matrix that can then be used to create a scatter diagram (see figure 12-1).

The dollar values occupy the vertical axis and the organizational rankings the horizontal axis. Thus, pricing a job structure involves a series of techniques and decisions regarding the vertical, horizontal, and regression-line dimensions of the scatter diagram.

The Vertical Dimension

The vertical axis of the scatter diagram is simply a set of dollar figures from low to high. This amount may come from either (1) the current pay rate or range for the job within the organization or (2) more commonly the value placed upon the job through salary surveys.

When current pay rates are used, an initial concern is the exact pay rate to assign to each-job. If there is a single job incumbent and/or a single pay rate for the job, then the particular dollar amount paid the job incumbent could be used, although this person might then be paid too high in the pay range for someone starting in this position versus the incumbent whose pay matched his growth within the company. But if there is a pay range and a number of incumbents, then the exact figure to use must be determined. If the average pay of the incumbents is used, the pay for the job may be overstated or understated depending on how long the incumbents have been on the job or what their performance has been. The alternative is to use the midpoint of the pay range. This gives a good indication of the relative value of the job and not the incumbents.

Another concern is whether to use the current pay or to adjust current pay to changes that have occurred since that rate was established. All pay rates can be adjusted by multiplying them by a constant percentage reflecting changes in the labor market, cost of living, productivity, or whatever other standard the organization decides to adopt.

When salary survey data are used, the figures need to be adjusted in a number of ways. First, the pay data do not provide a single rate but a range of figures. Therefore, the best single figure to use, such as the mean or median, needs to be determined.

Second, any data collected in the salary survey predate the effective date of the salary structure presently being built. Thus, the data need to be updated to the effective date of the new salary structure. This is usually done by multiplying the figures from the salary survey by some constant percentage based upon estimated changes in pay data during the interim or upon changes in a figure such as the cost of living.

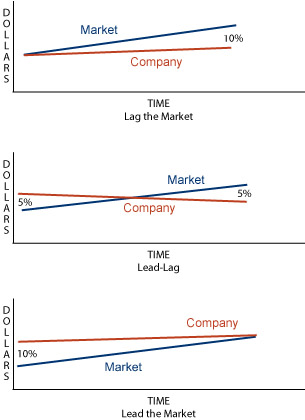

Third, the organization's strategy toward the labor market requires a pay level decision, since the new salary structure is going to be in operation over time. This decision involves determining how competitive the organization wishes to be while the salary structure remains in effect. There are three basic strategies for doing this:

- Lag the market. In this strategy, the organization updates the salary survey data to the current date and then installs the new salary structure. If a change in the labor market of 10 percent is assumed for the next year, then the only time the organization will be competitive with the market is at the beginning of the year. By the end of the year any decisions based upon the salary structure will be 10 percent behind the market.

- Lead-lag. Here the organization takes account of the 10 percent estimated change in the market but wishes to be on average with the market. It does this by starting the year at 5 percent above the market rate. Provided the increase is steady over the year, this strategy will place the organization ahead of the market the first half of the year and behind it the second half. At the end of the year the organization will be paying 5 percent under the market.

- Lead the market. In this strategy the organization wishes to pay above the market rate and does so by starting the year at 10 percent above the salary survey data. By the end of the year the organization will be paying the market rate.

These three strategies are illustrated in figure 12-2.

The Horizontal Dimension

The horizontal axis is the internal ranking of all the organization's jobs. The pricing process may work with either individual jobs or pay grades. In fact, if the organization is to employ rate ranges with differential pay rates for individuals on the same job, it may save time by making decisions on the pay-policy line, pay grades, and rate ranges at the same time. (Discussion of pay grades and rate ranges will start later in this chapter and continue in Chapter 13.) This is especially true if pricing makes use of both present rates and salary survey results, because the latter always represent a sizable range.

The major question involving the horizontal dimension is how the hierarchy of jobs was arrived at. There are three possibilities:

- Market Rates. The organization may assume that it wishes to pay strictly market rates for its jobs and may therefore place dollar values on both axes, making a totally consistent structure. Clearly this alternative assumes that there is a market rate for all of the organization's jobs and that this rate is satisfactory. This process, called Market Pricing, was discussed in chapter 11 and will be further discussed further at the end of this chapter.

- Job Evaluation Rates. Still the most common alternative for the horizontal axis is the set of ratings developed through job evaluation. Depending upon the method of job evaluation used, these ratings may consist of a ranking of jobs from low to high, a series of classification levels, or a range of points.

- Negotiated Rates. Where there is a union, the hierarchy of jobs may be a negotiated ranking based upon custom or the relative power of a group of unions.

Developing the pay-policy line

Once the horizontal and vertical dimensions of the scatter diagram have been agreed upon, all the jobs or the key jobs can be plotted as a point by their values on both axes.[See Figure 12-1]

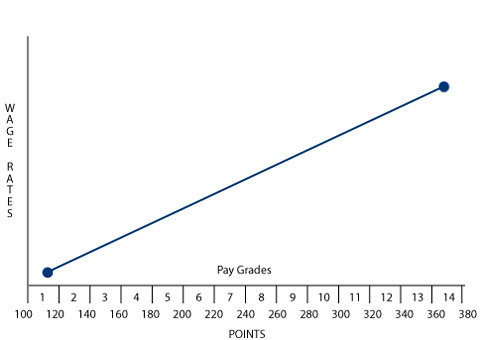

To create a smooth progression between pay grades, a pay-policy line is fitted to the plotted points. The line may be straight or curved and may be fitted by a number of different methods. When plotting job structures of single job clusters, a straight line is usually employed. The most frequently used types of lines are:

-

Low-high line. This is a straight line connecting the highest and the lowest of the plotted points

(these are often called anchor points). The rates of all intervening jobs are made to fall on the line.

The low-high line appears especially useful in union bargaining of the salary structure because of its

flexibility. When a final bargain is reached, it may be implemented by raising either end or both

ends in such a way as to reflect the contract. Figure 12-3 is an example of a low-high line.

Figure 12-3. Low-High Pay Policy Line -

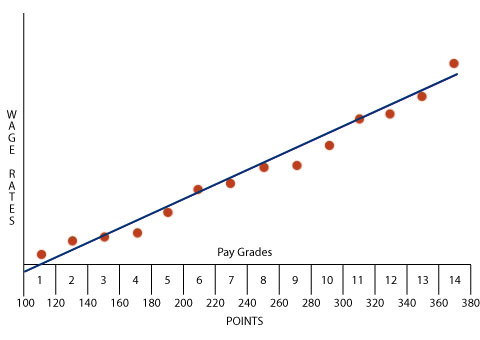

Freehand line. After the points have been plotted the trend of the data can often be easily visualized. In this case it is possible to draw a freehand line that best describes the plotted points. In drawing such a line, it is useful to follow the principle that vertical deviations from the line are minimized if the line follows the obvious slope of the data. Although the line may be straight or curved, its advantages are greatest when it is straight. The obvious advantages of using a freehand line are that it is easy to plot and simple to explain. Figure 12-4 is an example of a freehand line.

Figure 12-4. Freehand Straight Line - Least-squares line. The least-squares line follows the principles specified for the freehand line but is determined mathematically. It may be fitted by calculating the equation for the line and plotting the line obtained from the solution. See ERIDLC Course 49: Regression Analysis Used in Compensation Administration for instructions in computing a least-squares line.1

Which line is preferable?

Experience suggests that the additional accuracy of the least-squares line, compared with that of a freehand line, is seldom sufficient to offset the added difficulty of explaining the statistical method it uses. It may be useful to test pay lines developed by simpler methods against a least-squares line. Those with knowledge of statistics, however, may prefer a pay line calculated by least squares.

In most cases, a low-high (anchor-point) line or a freehand line achieves all the accuracy inherent in job evaluation results. Furthermore, both permit adjustments to achieve agreement of committee members or union and management on pay determinations.

In using salary survey results instead of present rates in determining the pay line, it is useful to employ a chart such as the one in figure 12-5, in which survey results have been presented as quartiles representing the pay grades of the organization.

When compared with present rates, such data enable the parties involved to make decisions on the salary structure. The medians (midpoints) or averages of survey results may, of course, be used in place of present pay rates in determining the pay line. The problem being that the inevitability of a range of rates (a minimum of 50 percent) raises questions about the usefulness of any single figure. Recognition of this may account for the practice of establishing rate ranges at the same time as standard rates for pay grades when salary survey results are used to price job structures. The starting rate of a pay grade must be sufficient to attract employees to those jobs, and salary survey results provide evidence of what that rate must be.

If the organization already has a series of pay grades in place, jobs may be slotted into the appropriate pay grade on the basis of the market rates that have been determined in the salary survey. This system can be called a rank-to-market job evaluation.1 It is similar to the classification method of job evaluation but does not incorporate the rules or grade-level descriptions of the latter.

Multiple Structures

So far in this section we have spoken only of a single salary structure. Actually, of course, an organization may have several salary structures - one for each broad job cluster, for instance. The choice may depend on whether job evaluation is formal or informal and, if the former, on which type of method is used. We saw in Chapter 14 that the ranking, classification, and factor-comparison methods can, if desired, derive one job structure for the organization. Even these plans, however, are often applied to distinct job clusters. The point method is more likely than any of the other three to be designed for a single job cluster. For organizations using market pricing where the horizontal axis is market rates the use of multiple structures may prove desirable.

Organizations with more than one salary structure most commonly have separate structures for exempt and non-exempt groups of jobs (see chapter 2). Exempts are often divided into professional and managerial groups, and non-exempts into production workers and office staff. There seem to be two reasons for these segmentations. One, it may be difficult to compare these different types of jobs, in which case the horizontal axis of the scatter diagram is not useful. Second, and more important, the slope of the pay-policy line for these groups may be very different. At opposite extremes would be the blue-collar workers, with a very flat slope, and the managerial group, with a very steep slope. Further, the pay-policy lines will start and stop at different places, so that there will be little overlap between them.

One serious problem can occur in constructing these separate structures: discrimination. If one or two of the groups contain all or many of the female or minority-dominated jobs, then the division may appear discriminatory. All job clusters that constitute a salary structure need to be examined for their sex and minority composition. If minorities and women are segregated, then the composition of jobs in all groups will have to be balanced by race and sex.

COMPLETING THE SALARY STRUCTURE

At this point in the discussion the wage structure consists of a horizontal dimension and a vertical dimension with a pay-policy line derived from the plotting of jobs. Theoretically, this wage structure as pictured in figure 12-1 could be used to establish wage rates for jobs as every job in the organization could be plotted on the pay-policy line to determine its pay rate. However, in many ways it would be inadequate and inefficient. For the sake of convenience and practicality most wage structures group data on both the horizontal and vertical dimensions. On the horizontal dimension, jobs are grouped into pay grades; on the vertical dimension, money is grouped into rate ranges.

Pay Grades

If figure 12-1 were used as the salary structure each job would be its own grade and the administration of compensation very complex. It makes more sense to group jobs and to have a limited number of pay grades by grouping jobs that are close together in the hierarchy into grades for pay purposes. This way, in large organizations at least, much time and effort are saved. Dealing with ten pay grades rather than hundreds of job rates is convenient for all parties. Where job rates are used, even small changes in duties may require changes in pay rates.

A pay grade is defined as a group of jobs that have been determined by job evaluation or other measure on the horizontal dimension to be approximately equal in difficulty or importance. If a point plan is employed in job evaluation, a pay grade consists of jobs falling within a range of points; if factor comparison is used, a range of evaluated rates; if ranking is used, a number of ranks. In the classification method of job evaluation, a pay grade consists of all jobs that are comparable to the level description.

There appears to be no optimum number of pay grades for a particular salary structure. In practice, pay grades vary from as few as 4 to as many as 60. If there are few grades, the number of jobs in each will be relatively large, as will the increments from one grade to another. If, on the other hand, there are many pay grades, the number of jobs in each grade and the increments between grades will be relatively small.

Although organization practice varies greatly, there has been a tendency to reduce the number of pay grades. Ten to 16 grades for a given job structure appears to be common. Ten grades for non-supervisory factory jobs is typical, as is 13 for clerical job structures. Broader salary structures, of course, contain more grades. For example, salary plans that encompass clerical, professional, and administrative employees average 16 grades. Pay distance between grade midpoints is commonly 5 to 7 percent for hourly and clerical jobs and 8 to 10 percent for professional and administrative jobs.

The actual establishment of pay grades is a decision-making process designed to:

(1) place jobs of the same general value in the same pay grade,

(2) ensure that jobs of significantly different value are in different pay grades,

(3) provide a smooth progression, and

(4) ensure that the grades fit the organization and the labor market. Examination of job evaluation results may yield natural cutoff points.

Before determination of pay grades, it may be wise to determine both how many jobs and how many employees are affected by the number of grades and the division chosen. This can be done by plotting each employee on the salary structure matrix and noting whether there is a spread of employees over the matrix. Since large numbers of employees may be affected by small changes in pay grades, great care and fairness must be used in determining pay grades. Grievances can be avoided by seeing that pay grades with large numbers of employees are not placed in a grade that negatively changes their pay rate.

Because jobs in a pay grade are treated as identical for pay purposes, it is extremely important that grade boundaries be accepted. For this reason, it is often useful to move jobs that are very close to the maximum cutoff point into the next higher grade.

There are a number of ways of grouping jobs into a limited number of grades. Four of them are discussed here.

Cluster Approach

The simplest approach is to make a scatter diagram of the organization's jobs, as is done in establishing the pay-policy line. When this is done it can often be observed that the jobs tend to cluster rather than scattering evenly. This effect can be taken advantage of by encasing the clusters horizontally and vertically, as illustrated in figure 12-6. This provides all three dimensions, but none of them is arrived at consistently, nor are they likely to be symmetrical. This may have a negative impact on salary and career progression within the organization.

Clustering has the advantages of simplicity and flexibility: it can be changed each time the salary structure is adjusted. It tends to be used with ranking or slotting methods of job evaluation, so small organizations are most likely to use this approach.

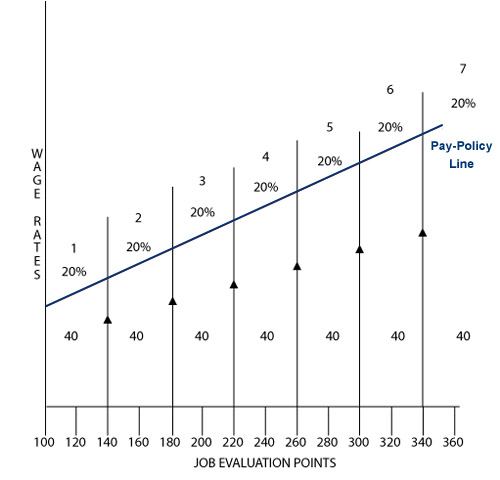

Division Approach

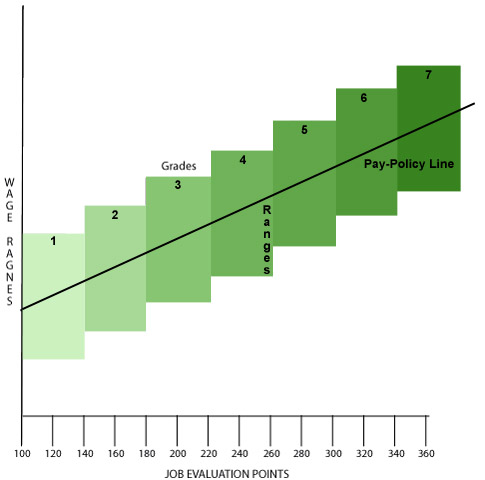

Another relatively simple approach is to use the horizontal dimension of the salary structure, usually the job evaluation points, to determine the number of pay grades. This is done most easily by determining a set number of points for each pay grade and, starting with the least number of points, marking off the lines between adjacent grades. In figure 12-7, each pay grade is 40 points "wide."

An alternative to using a set number of points for each grade is to use increasing numbers of points as we move up the scale. This would reflect the difficulty experienced in job evaluation of determining exact differentials between jobs higher in the hierarchy. In the division approach, the job rate for each grade should be set by placing the range midpoint at the point where a vertical line from the point value in the middle of the grade, say 200 points for level 3 in figure 12-7, meets the pay-policy line. This method can be used successfully with a point system of job evaluation and can also be adapted to other systems, such as classification.

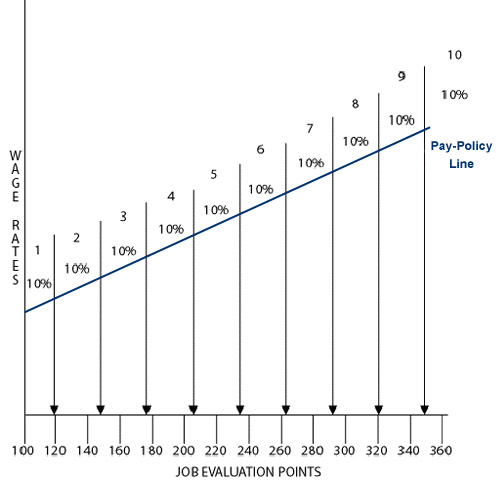

Midpoint-Progression Approach

This method is a little more sophisticated and allows for broader definition at higher grades. It focuses on the pay-policy line and the vertical axis of the salary structure. This time the number of pay grades is obtained by determining a standard distance between the midpoints of adjoining grades. In figure 12-8, 10 percent is the distance decided upon between grades.

Starting at the midpoint of the lowest grade, we place the midpoint for each succeeding grade 10 percent higher than the lower one. The dividing line between grades is halfway between the two midpoints. As can be seen, the horizontal dimension of job evaluation points widens with each higher grade.

This approach is often combined with increasingly broad rate ranges to make the salary structure balloon out at the higher levels. The rationale is that at higher levels, positions are harder to define and evaluate accurately, and greater variation in performance is possible.

Continuum Approach

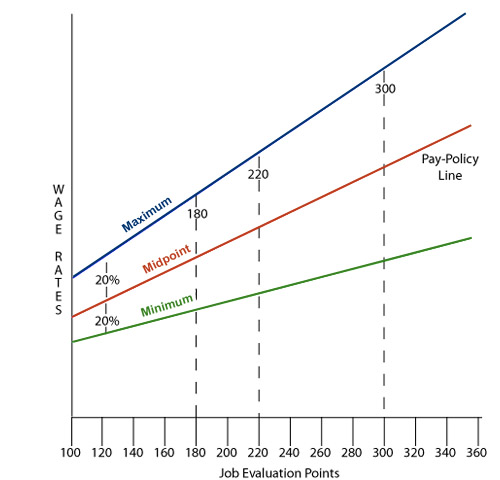

In this approach each job evaluation point on the horizontal axis has its own rate range; there is no grouping of jobs. The pay-policy line constitutes the midpoints. A standard maximum and minimum which are a set percentage above and below the midpoint are defined. As can be seen in figure 12-9, these lines widen as the pay level rises, making the range broader at the top than at the bottom.

The continuum approach has gained popularity with the Hay Plan (see Chapter 11), which uses it. As noted, a system such as this requires a lot of confidence in the job evaluation system. It is likely to engender considerable argument over small differences in the number of points assigned to jobs. Small, technically oriented organizations are most likely to use this method.

Rate Ranges

Just as it is useful to group jobs on the horizontal axis; it is useful to use a range of pay for each pay grade created. A range of pay allows an organization to move beyond pay for the job to pay for the person. Since this is the topic of chapters 13 and 14 the rationale for it will not be covered in depth here. Factors important in rewarding people for other than the job, such as performance, can be accommodated by a rate range. Since the data from which a job rate is taken comprises not a point but a range, using a single job rate may create an aura of accuracy that is unwarranted. Also, since a pay grade incorporates a range of job evaluation points, it is useful to have some range of pay for the grade.

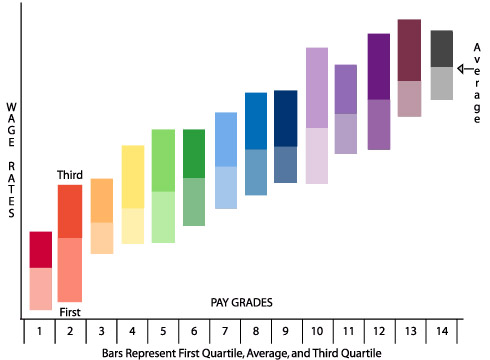

Ordinarily, the midpoint of the range will be the job rate, the mean or median of the salary survey data. The other points to define are the minimum and maximum of the range. The range spread, the distance from minimum to maximum, varies greatly but is usually within a 25 to 60 percent range. Many salary structures for large organizations with a variety of jobs are narrow at the bottom and spread out at the higher levels.

Once pay grades and rate ranges are designed, the salary structure is complete (see figure 12-10).

Broadbanding

The salary structure that we have described here is consistent with and supports the typical hierarchical organization. Some organizations strive to be more flexible to improve their responsiveness to the changing economic conditions and remain profitable. This has resulted in smaller, flatter organizations in which being limited to specific job definitions is less important and being able to do what needs to be done is more important. This in turn has created a need for Human Resources to adapt their practices and one way they have done this is to adopt broadbanding.

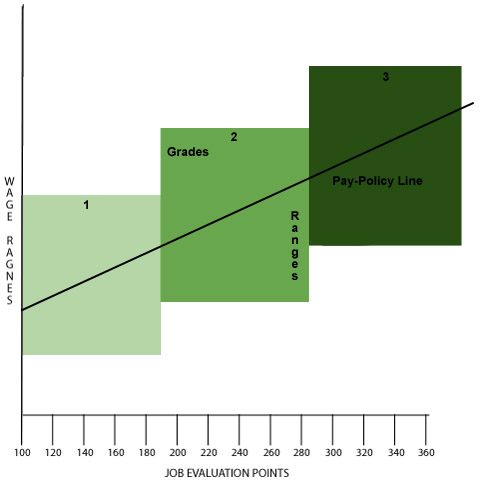

The essence of broadbanding is the reduction in the number of pay grades down to a minimum number of very broad grades with much wider pay ranges. As broadbanding has progressed it has developed two distinct approaches:

- Broad Grades. Organizations using this approach have a few broad grades in their salary structure, each one having a wide pay range that may overlap other grades significantly. These types of structures most often retain the control aspects of the salary structure, using midpoints, quartiles and minimums and maximums.

- Career Bands. Again, this approach has very broad grades and ranges or at the extreme none at all. However, the emphasis in this approach is to group employees by occupational or career areas and emphasizes career planning and training so salary movement is most likely influenced by changes in the employees' competencies that are related to organizational goals.2

An example of broadbanding is illustrated in Figure 12-11. This chapter will look at broadbanding in the first sense and leave the second approach to the chapter 15 on Competency Pay.

The roots of Broadbanding go back to the 1970's and General Electric but it was in the early 1990's when organizations were doing a great deal of hierarchy flattening that broadbanding became popular. The idea took hold for a while and then fell out of favor. Today, it is seeing a resurgence in use.

Reasons to use Broadbands include:

- Creating organizational flexibility. This factor seems to top all lists.

- Reduce or de-emphasize hierarchy. This would include the move toward flatter organizations.

- Encourage employees to improve their competencies and engage in career development.

- Support a change in organizational culture, quite often associated with a merger or acquisition.

- Link to market-based compensation. This seems to be a strange one since at first glance broadbanding would seem to de-emphasize market position in pay.3

Design of Broadbanding. The end product of broadbanding is a salary structure of a minimum of pay grades with very wide pay ranges. The actual number of bands depends upon the size and complexity of the organization and the purposes to be achieved by the program. In practice it seems that a median number of bands is 5. There are two bases for establishing these bands:

- Hierarchy and/or Market Price. The bands may reflect the organizational levels. These might be Executive, Managerial, Technical and Professional Staff, Administrative Staff, and operators. This latter would include all non-exempt employees. This division would follow very closely the market value of the jobs within the organization and any overlap would be able to be taken care of with wide, overlapping ranges of the bands.

- Job Families or Occupations. Bands based upon this criterion would consist of all jobs with similar competency requirements usually in a series of steps from beginner to expert or some such distinction. Obviously, this method is most appropriate when the reason for initiating broadbanding is employee development. These kinds of plans downplay the idea of promotion and place a premium on learning new skills.

One interesting fallout from redoing and consolidating pay grades is a reduction in the number of established job titles in the organization. All this seems related to the idea that not only does the organization need to be flexible but so do the employees.

Both of these criteria will produce bands that cover a wider range of jobs from a market standpoint than traditional grades. Thus the ranges for these bands will be much broader, ranging from 100% to 400% spreads.

Pricing the bands can then be done by reference to the market. Pricing often is done within groups that make up the band. Thus, finance jobs may be priced differently within the band than engineering jobs. In fact, the total band may have a number of sub-areas each with a different rate range. This would seem to destroy the idea of a wide band and make the structure look more like a standard salary structure. The difference may be that these sub-ranges are perceived as reference points and not as control points and there are not midpoints and other ways of maintaining limits on pay rates.

Broadbanding concerns - while broadbanding has worked well for the most part, there have been problems with it:4

- Costs May be Higher. This is a control issue. Banding gives supervisors more latitude in what they pay employees. It is possible that the organization could get into a cycle of paying well above market for many or all jobs in the organization. In addition, supervisors may use criteria that are based upon favoritism and not on market forces. One study has shown that broadbanding indeed does raise the cost of labor above the going market rate.5

- Discrimination. Again, without the controls that a standard salary structure provides it is harder to know whether the banding program contains discriminatory practices. Any time decisions like this are delegated the possibility for misuse of the system increases either purposely or through lack of training. There is little evidence that broadbanding organizations have more problems than others with regard to discrimination.

- Broadbanding vs. Market Pricing. Over or underpayment could be a real problem in broadbanding. In fact, this is the reason that most organizations using broadbanding break the bands into clusters of jobs for which there are known market rates and keep the pay for these sub-groups within the market parameters. As discussed above this may in fact destroy the basic purpose of broadbanding.

- Changing Job Titles. Broadbanding usually results in a reduction of job titles in the organization. The job titles also are broadened. This can upset employees when "my job is who I am." In fact, one organization that developed many generic internal job titles kept the external job titles, as represented on business cards, the same.

- Career Development Automatically Takes Place. Broadbanding improves the circumstances for examining and developing a process of career development but without a great deal of effort it will not take place. In other words, broadbanding is not a replacement for a carefully planned out and executed career planning process. Broadbanding is simply a supporting program.

-

Implementation. While proper design is imperative to successful broadbanding, it will come to

naught if good implementation is not followed. Some of the areas that need attention are:

- Support of Top Management. Top management must be the sponsor for the program. One that appears to emanate solely from Human Resources is destined for failure.

- Communication. There needs to be both a quantity and quality of communication about the program disseminated throughout the organization. This can and should be done in a number of ways. Remember that communication goes in both directions. Getting feedback is a major part of good communication.

- Training. Managers and supervisors need to be trained in the purposes and practices of the project. Employees who need to do things like make new job descriptions also need training to complete their part properly.

MARKET PRICING

Earlier in this chapter we said that the horizontal axis of the salary structure could be represented by any one of three things. One of these is the current market rate for the job[s]. This makes both the horizontal and vertical axis use the same measure. The effect is that the structure is dictated entirely by the external labor market and not at all by internal values of jobs. This rate is called Market Pricing and it uses external salary survey data to establish the worth of jobs.

A common statement heard today is "We only do market pricing" or put another way "we don't do job evaluation."6 It is estimated that up to 80% of organizations use market pricing as their primary method of setting wages. How did this come about? Many of the forces are the same as those that led to the development of broadbanding including the need for flexibility and a desire to move away from traditional salary structure techniques that supported a bureaucratic type of organization. Factors more unique to market pricing are:

- Critical Talent. In a number of areas, such as IT, the market moves very rapidly. The traditional salary structure has been unable to respond to these rapid changes. This is in two ways. The first is a rapid movement of wages when the traditional structure is designed to last for a period of time, most often a year. The second part is that these rapid movements moved the job value up and into the pay range of higher-level jobs thus disrupting the traditional salary structure.

- Competition. Competition has been the hallmark of the past twenty years for organizations. The organizations' culture is permeated with competition and looking outward to other organizations. The value of internal equity has been downgraded. It is more important to find and hire the person with the currently needed skill than to be concerned with internal job relationships.7

Designing a Market Pricing System. The two steps in establishing a market pricing system are to collect market pay data and to fit that data into a salary structure. The first of these steps will not be covered here. It has already been covered in Chapter 8. [See also DLC Course 73: Analyzing Salary Surveys]. The second part has been mentioned in each section of this chapter. Basically, the horizontal axis which ordinarily has the job evaluation values is replaced with salary survey data for each job or at least key jobs. Grouping jobs into grades and developing rate ranges can be done in the same manner as described above.

Problems of Market Pricing

- Out of Line Rates. To call a rate out of line may be a bit strong. The problem is that pay rates move

up and down, sometimes rapidly with changes in supply and demand. This makes the current pay rates being paid out

of date. If you set up a scatter diagram with the market rates on the vertical axis and current rates on the

horizontal axis there will be jobs that fall above and below the line. In market pricing these jobs should be

adjusted to fit the line. But to do so comes at a cost. If the job is moved upward this moves it upward in the

job hierarchy of the organization. This can create feelings of inequity among other employees who feel that their

job is as important or more important than the adjusted job. If the job falls below the line, the pay rate

should be reduced or at least held steady while most others are moving upward. This creates a motivational

problem for the affected employees.

Further, labor markets can also move quite quickly. To keep up may mean making changes quite often. Jobs that are in short supply may move up rapidly and right back down as conditions change. All this can create an unstable salary structure within the organization. - Jobs with no Market Rate. Typically, not all the jobs in the organization have a market equivalent. How are such jobs to be placed into the salary structure? It is necessary to use some form of job evaluation no matter how primitive. Perhaps the most used technique if there is no formal job evaluation available is that of slotting the job. In this technique two jobs are chosen that appear to be somewhat higher and somewhat lower in their importance to the organization and the subject job is compared to these two for an evaluation of how close the job is to each of the comparison jobs and then the pay rate is set based on whatever percentage the job appears to be of the distance between the two comparison jobs.8

Reconciling Internal and External Wage Values

From the above discussion it is clear that a pure market pricing system probably does not exist. To some extent internal values will have to be taken into account and the organization will need to consider these internal values to advance its compensation goals. In practice, organizations that claim they use market pricing vary considerably in the amount of data they collect. Data gathering has its costs, so many organizations collect data on a select group of key jobs and extrapolate the results to the whole salary structure. So it is not just a question of using internal or external values but what weight to put on each one. Given the large number of organizations that claim they use market pricing the weight is clearly toward external values.

This emphasis is consistent with changes in the employment relationship in the past twenty years. When employees expected to stay with the organization and move up by promotion then internal values were consistent with this approach. However, this changed, and employees found themselves downsized and working for a number of organizations in different kinds of jobs. Likewise, organizations that used to move employees up within the organization and hire only at the entry level, now hire employees at all levels. This puts more emphasis on external values.

Regardless, there will always be a conflict between market rates and rates that are derived from internal sources. Job evaluation is an attempt to substitute rationality for a variety of non-rational influences on salaries by appraising jobs in terms of their contribution to the organization. The process presumably produces a hierarchy of jobs that accords with both organizational requirements and employee values, including customary relationships. This internally developed job structure is logically, at least, somewhat different from that of any other organization.

Market rates, on the other hand, represent a composite of prices paid by organizations of every size and type. Some jobs are never filled from the outside labor market but rather are occupied by employees trained within the organization. Some organizations are almost completely insulated from most labor markets, except in the case of jobs for which they cannot provide training. Even if jobs in different organizations are identical, the chance of their occupying the same position in the job hierarchy is small. Even highly skilled jobs may vary in importance to the various organizations. Thus, no job-evaluated salary structure is immune to conflict with market rates.

The only way an organization could avoid such conflict would be to pay at or above the market rate on every job. But the severity of any conflict varies considerably from one organization to another. Low paying organizations may experience conflict on many jobs. Organizations employing largely semiskilled workers and promoting from within have less conflict than organizations employing many highly skilled workers who must be hired from the outside for these jobs. If there is unemployment in the local labor market, less conflict between market rates and evaluated rates occurs, even in low paying organizations. Typically, geographically isolated organizations or those with large numbers of unique jobs experience less conflict.

That the position and meaning of the same job rate vary from organization to organization makes it easier to solve the conflict. If the job is a hiring-in job, the organization may have no choice but to pay the market rate. If not, the importance of the conflict depends on the position of the job within a job cluster. If the job is related more strongly to associated internal jobs than to the market, the market rate is much less important. If jobs that are keyed to the market are at or above market rates, internal relationships are likely to prevail.

Some job clusters are market-oriented, usually because the organization cannot provide the training needed or because the union discourages intra-organization comparisons. Other job clusters are essentially insulated from the market, except for hiring-in jobs. But tight labor markets tend to market-orient any job cluster in which the organization does not provide its own labor supply by promotion or transfer from within. Although changes in market rates vary in amount and even direction for separate job clusters, in periods of generally tight labor markets, there is some similarity among these movements.

The basic solution to conflict between market rates and evaluated rates is to develop a number of salary structures. In this way, a job cluster that must be tied closely to the labor market will not seriously disturb other salary structures. A less preferable solution is to exclude certain jobs or job clusters from job evaluation. This approach is difficult to defend and endangers internal relationships.

Salary structure decisions as outlined in this chapter attempt to balance internal considerations and external considerations (market rates). Most organizations achieve this by developing a number of separate salary structures and by emphasizing flexibility in pricing job structures. Low paying employers in competitive industries, especially those operating in tight labor markets, may have to abandon their interest in internal relationships and concentrate on keeping jobs filled by paying market rates. In fact, they may have to lower their hiring standards as well.

Solutions to conflicts between market rates and evaluated rates are impacted by unionism. If the job evaluation plan is a joint one or if the union is interested in consistent internal relationships, solutions are facilitated. Trade unionism, rival unionism, and lack of interest in internal relationships make any attempt at finding solutions more difficult.

ADMINISTERING THE SALARY STRUCTURE

The salary structure developed in this chapter is designed to take the organization one step closer to the goal of figuring out what to pay the individual employee by defining a pay rate or range for the job. The implementation of the structure involves a number of issues and problems, which we will deal with in the remainder of the chapter.

Administration Issues

Decisions about the design of the salary structure affect the paycheck of all employees. From the standpoint of equity within the organization, it is important that the way in which these decisions were arrived at is clearly understood and accepted by all parties. From an external perspective the organization must deal with the question of its competitiveness in the labor market compared with these internal considerations. The issues to be dealt with in this section focus on these two aspects of equity.

Responsibility for salary structure pricing

If the job structure is determined through formal job evaluation, pricing responsibility depends heavily on whether the organization has a union and on how extensively the union participates in the job evaluation program. If job evaluation is a union-management venture, the union is obviously represented on the committee that prices the job structure. If job evaluation is conducted by the employer alone, the union in collective bargaining may accept the job structure developed, accept it in part, or ignore it. In each of these cases the pricing process is the result of collective bargaining, at least on key jobs and optimally on all jobs.

This process of developing a salary structure has generally fallen to the Human Resources Department with expertise in compensation. With the advent of market pricing, line managers are more active in the process of establishing pay rates if not the whole salary structure. A plethora of information is more readily available to both managers and employees, so the process of setting pay rates becomes more of an active bargaining between employees, with or without a union, and their managers. Human Resources maintains more of an information giving role as well as a control function.

Pricing jobs

When pay grades are used, the specific rate for a job is attached to the pay range in which the job is located. A system of code numbers identifying the jobs and their proper pay grade facilitates control and record keeping. Determining an actual pay rate for a job within the pay grade is the subject of Chapters 13 and 14.

Some organizations prefer to work with a job structure composed of individual jobs rather than pay grades. Such organizations may have difficulty convincing managers that cutoff points are necessary and that efforts to move borderline jobs into higher pay grades destroys the usefulness of the system. For small organizations in particular, pay grades may result in little savings.

If a job structure of individual jobs is to be priced, the procedures are largely the same as those we have covered. The essential difference is that adjustments are made to accommodate the different job evaluation plans. If a point plan is used, points and rates for separate jobs may be plotted on scatter diagrams. With factor comparison, evaluated rates instead of points are plotted and a choice may be made between plotting only key jobs in the pricing process or plotting all jobs. In a ranking plan, jobs are recorded by rank and job-rate adjustments are made to correspond with the ranking.

Job Analysis and Description

Job changes call for changes in job descriptions and job evaluations to ensure that the changed jobs carry the appropriate pay rate. New jobs call for job analysis and job evaluation to determine the appropriate rate. Both cases represent additional effort for busy supervisors and managers, even if the analysis and evaluation are done by others. As such, there may be a tendency for managers to neglect these chores.

However, consistent salary structures require that these changes be made promptly. In addition, under union conditions failure to make such changes can foreclose the organization's right to make job changes. In a number of cases, management has lost a considerable portion of its right to make job changes by failing to make prompt changes in job descriptions. By custom and practice, employees may acquire the right to do certain work and to refuse to do work not called for in job descriptions. Major union-management problems have been caused by neglecting salary administration, such that custom has come to limit management's rights to make changes. Much of the problem can be attributed to failure to educate managers on pay administration. Unless managers realize the importance of keeping pay structure changes in tune with job changes, any program of pay structure maintenance is likely to degenerate into detective work.

Reclassification

When employees change jobs and when new employees are assigned to jobs, employee classification determines the job description that applies to the work the employee is doing and the appropriate pay rate. A pay rate cannot be assigned to an employee until he or she has been classified as performing a certain job.

Classifying new employees properly and changing classifications when employees change jobs are essential to maintaining consistent pay structures. But, like job changes, they represent additional work for busy managers. Again, unless managers understand that employee misclassification destroys pay relationships and creates vested interests that are difficult to change, they are likely to neglect reporting employee changes and to inappropriately classify employees.

Technological Change

Technological change affects salary structures by accelerating changes in jobs. As mentioned, when jobs change their place in the job structure, the entire salary structure may change. The issue of whether technology brings an upgrading or downgrading of jobs has become a lively controversy in the literature. It appears to have been established, however, that technology reduces the number of separate job classifications. Broader job classifications take account of the interdependence of automated jobs and the tendency to move people from job to job.

Broader job classifications mean broader job descriptions and less frequent changes in employee classification. Thus if the broad job descriptions represent reality, problems of maintaining salary structures may be reduced.

In practice, few jobs are actually downgraded as a result of technology. This may mean that job changes resulting from technological change do not reduce job-related contributions. It may also mean that automation creates new rather than changed jobs.

A third possibility is that some jobs do require fewer contributions, but organizations do not choose to evaluate them downward. There is no evidence that downgrading is more frequent in nonunion than in unionized organizations.

Technological and other changes, over time, may require basic revision of the job evaluation plan – in factors, weights, or both. If the model of the employment exchange used in this book is correct in implying that many employees want to make more contributions than organizations have chosen to recognize, these desires plus technological change may require such revision. A careful audit of job evaluation plans and pay structures at least every three years would be a good way to carry this out.

Environmental Changes

Product markets, labor markets, legal requirements and union-management relationships also change and require adjustment of job and pay structures. Product-market conditions may change the labor cost associated with jobs and force organizations to align their economic resources. Labor-market changes may produce shortages of certain employee groups and compress pay structures. Changes in unions, in the internal politics of unions, in collective-bargaining agreements, and in union-management relationships may foster or inhibit union interest in internal salary structures and may make salary structure administration easy or difficult. Unions can aid or hinder organizations in making the adjustment in salary structures that environmental changes require.

Today, legal requirements are placed upon the organization to not discriminate against women, racial groups, and, in certain circumstances, age, religious, and handicapped groups. The current pressure today is that of comparable worth, which will be discussed in Chapter 27. As indicated, an organization should be careful that any salary structure it establishes has a balance of gender and racial groups and is not isolating these groups into a salary structure that treats them differently.

Maintenance Procedures

Problems of salary structure administration emphasize the importance of job evaluation maintenance. Maintenance, at a minimum, consists of (1) keeping job descriptions and job evaluations up to date and (2) seeing that employees are actually performing the jobs outlined in the job descriptions. The Compensation Department may be assigned to (1) analyze new or changed jobs, (2) see that job changes are reported, (3) see that descriptions and evaluations are kept current, (4) see that identical jobs have identical job titles, and (5) receive and process appeals and grievances with respect to job evaluations.

Supervisors are normally responsible for advising the Compensation Department of any changes in job content that they are planning to make or have made. They are likewise responsible for seeing that employees are assigned to tasks and duties included in their job descriptions. To facilitate carrying out these responsibilities, supervisors may be required to review regularly with each employee the description of his or her job and, if the job description is not adequate, to request a new analysis and evaluation. Some organizations require that approval for job changes be obtained before such changes can be made. It is doubtful that this practice can be justified in a dynamic organization. If job changes are reported and subsequent reevaluations are made promptly, such rigidity would not seem to be necessary. If, however, supervisors are guilty of shifting duties in order to manipulate pay rates, some method must be found to discourage the practice. In addition to supervisory requests for job reevaluation, other methods may be used to maintain the job evaluation system. The Compensation Department may be set up to audit jobs in all departments on a continuing basis. Thus, each department's jobs would be subject to regular audit. Interim checks might be made, however, by regularly checking departmental job lists against a list of standard job titles.

Another device is to limit the life of job descriptions. Thus a job description would be valid only for a certain period, after which the job would have to be reevaluated.

A further check on the adequacy of job information and the correctness of job evaluations is the grievance or appeal procedure. Employees should be encouraged to appeal whenever they believe their job description or job evaluation is incorrect. If the organization is unionized, the regular grievance procedure may be used. If the organization is nonunion, an appeal procedure may be introduced. In either case, a request for reevaluations of the job is made early in the procedure. If the matter is still not settled after the compensation department reevaluates the job, it is sent up the line until agreement is reached.

Standard job titles are an essential part of job evaluation maintenance. Such standard titles should apply to all jobs that entail identical duties and responsibilities, wherever they are found in the organization. The Compensation Department manages the use of these job titles to see that they are used only where they apply.

SUMMARY

The salary structure is a combination of the job structure of the organization and the market rates for those same jobs. A graph representing the salary structure usually starts with the job structure on the horizontal axis, represented by the job evaluation values given to the jobs. The vertical axis represents the market rates expressed in monetary terms. Each job, or those jobs for which there is a market comparison, can be represented by a point on the graph. A line of best fit can then be drawn that creates the pay-policy line for the organization.

The pay-policy line is the starting point for creating the salary structure. The values of both dimensions need to be grouped in order to make compensation administration more manageable. The horizontal axis, the job structure, is grouped into pay grades. This grouping may be done in a number of ways as discussed in this chapter. The number of these pay grades has become a matter of discussion as organizations have moved away from a few grades, a process called broadbanding, to using ten or more depending on the size of the organization.

The vertical axis is grouped for each pay grade into a rate range. The methods for doing this will be discussed further in the next two chapters, as this provides the opportunity for the organization to pay differential amounts to people on the same job or on jobs in the same pay grade.

The salary structure is the place in compensation administration where the labor market meets the internal values of the organization. This juncture is not always congruent. Organizations have a structure of jobs that depends not only on market value but on a range of organizational, psychological, and sociological factors. Often these factors are represented in a collective bargaining situation. The requirement of organizations to respond to the labor market differs considerably, so settling any conflict between organizational and market value is a matter of judgment within the organization. The changing climate of organizations has made market value the predominant tool used as many organizations move toward using market pricing to establish their salary structure. Any salary structure is only useful for a limited period of time. Changes in both the labor market and the organization make redoing the process over time a necessity.

Footnotes

1 J. Schuster, Management Compensation in High Technology Companies (Lexington, Mass.: Heath, Lexington Books, 1984).

2 Abosh, K & Hand, J., Life With Broadbands, Scottsdale, AZ. World at Work, 1998.

3 Enos, M. & Limoges, G. "Broadbanding: Is That Your Company's Final Answer?" World at Work Journal, Fourth Quarter 2000, pp. 61-68.

4 Abosch, K., "Confronting Six Myths of Broadbanding" ACA Journal, Autumn 1998, pp.28-36.

5 Fay, C., Schultz, E, Gross, S., & De Voort, "D. Broadbanding, Pay Ranges and Labor Costs," World at Work Journal, Second Quarter 2004, pp.8-23.

6 Hinchcliffe, B., "The Juggling Act: Internal Equity and Market Pricing," Workspan, Scottsdale, Az. World at Work, Feb. 2003, pp.46-8.

7 ------------, "Market Pricing: Methods to the Madness," Scottsdale, AZ. World at Work, 2002.

8 Grigson, D, Delaney, J. & Jones, R., " Market Pricing 101: The Science and the Art," Workspan,, Scottsdale, Az. Oct. 2004, pp. 46-52.

Internet Based Benefits & Compensation Administration

Thomas J. Atchison

David W. Belcher

David J. Thomsen

ERI Economic Research Institute

Copyright © 2000 -

Library of Congress Cataloging-in-Publication Data

HF5549.5.C67B45 1987 658.3'2 86-25494 ISBN 0-13-154790-9

Previously published under the title of Wage and Salary Administration.

The framework for this text was originally copyrighted in 1987, 1974, 1962, and 1955 by Prentice-Hall, Inc. All rights were acquired by ERI in 2000 via reverted rights from the Belcher Scholarship Foundation and Thomas Atchison.

All rights reserved. No part of this text may be reproduced for sale, in any form or by any means, without permission in writing from ERI Economic Research Institute. Students may download and print chapters, graphs, and case studies from this text via an Internet browser for their personal use.

Printed in the United States of America

10 9 8 7 6 5 4 3 2 1

ISBN 0-13-154790-9 01

The ERI Distance Learning Center is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: www.learningmarket.org.